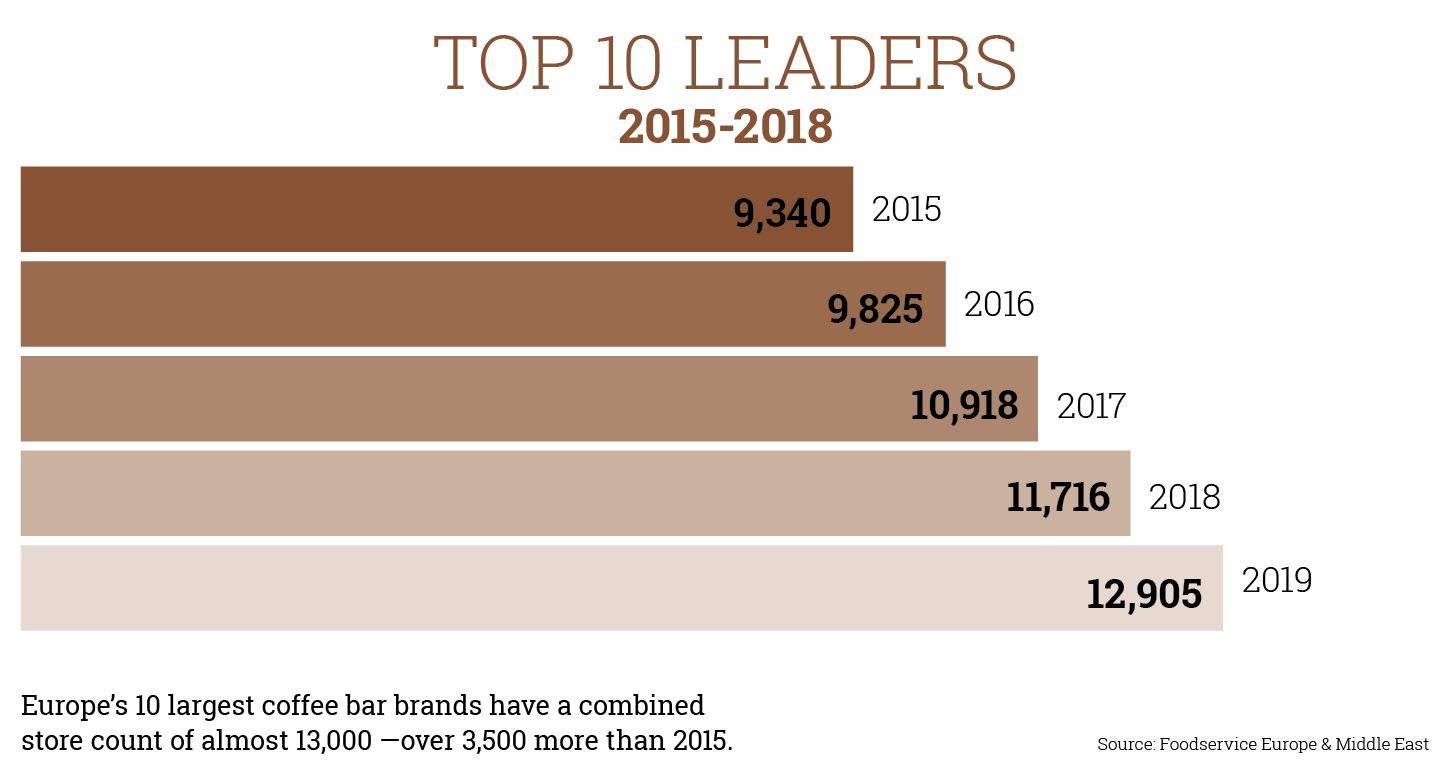

An exclusive analysis by respected magazine FoodService Europe & Middle East portraying the market before the corona pandemic hit, shows that the top 80 coffee-shop brands saw growth with 7% more outlets.

Namely, the ten foremost brands unite about two thirds of the 80 concepts listed in total in the survey. Among them, four Greek brands, with two of them, Coffee Island and Gregory’s, placed in the Top-10 and the other two, Everest and Flocafé Espesso Room, occupying the 14th and 31st place, respectively.

Coffee Island in 8th place

According to Food-Service Europe & Middle East, Greek coffee-bar chain Coffee Island occupies eight place (no change from the previous ranking) and has increased its store number by 5% to 454 in 2019. The brand has stated that although 2019 showed a positive growth rate with fruitful outcomes, operators had to work in a highly agile business environment, where competition got fiercer and consumers had rising expectations from the key players, not only as regards coffee quality, but mainly as regards their daily experience. In fact, Coffee Island places personalized customer experience at the top of the three top trends in the coffee-bar market.

Gregory’s climbs to 9th place

The second chain with a Greek origin among the Top 10, climbing up from 10th place, is Gregory’s, with 5% more bars. The strongest countries in terms of sales are Greece, Germany and Romania, while the brand is focusing on boosting products catering to specific dietary needs, such as vegan or healthy.

The other Greek businesses on the list

Everest, owned by Vivartia Foodservice Group is in 14th place (down from 12th) with 213 units and 0% growth from the previous year. Flocafé Espesso Room, also owned by Vivartia Group, is in 31st place, moving down six places for number 25 it occupied in the 2018 survey. Flocafé has decreased its store number by -2% to 104 units, probably slowed down by changing consumer habits as well as the economic crisis that hit Greece in 2010 and is still proving difficult to surmount.