Being one of Europe’s largest markets, with a vast, yet knowledgeable consumer body, Germany is a dream market for many exporters, yet a highly demanding one, given the fact that local agents, as well as major retail chains, have concrete expectations in terms of quantities and production stability. Mr. Theodore Xypolias, Head of the Office for Economic and Commercial Affairs of the Greek Embassy in Berlin explains to Ambrosia Magazine the particular features and specificities of the German market and gives us an insightful overview of the current commercial relations between the two countries.

Interview: Charitomeni Vonta

What would you say is the greatest asset of Greek f&b products in your market?

The greatest capital/advantage of Greek f&b producers is the quality and the long-standing relationship of trust, which has been built over the years with German consumers. Germans now know that Greek products are synonymous with quality, and they trust them. This, in fact, is constantly proven in the most official way. For example, a few days ago the largest consumer institute of the country (StiftungWarentest) included in the top 3 olive oils of the local market a product originating from Crete, which took 2nd place among 23 competing labels. Accordingly, there is an increase in the presence of other branded and quality Greek products in the local market, such as quality wines, fish, cheese, delicatessen products, etc.

* Which Greek products have the greatest potential, and how could their dynamics improve?

The Greek presence in the local food market covers a wide range of products, with strong development prospects. I indicatively point out the following:

Fruit and Vegetables: Greek exports of fresh fruit and vegetables to Germany are constantly increasing. At the recent International Exhibition FRUITLOGISTIKA 2024, (7th to 9th of February) which takes place in Berlin on an annual basis, we found that Greek producers and distributors have succeeded in reaching partnership agreements with the country’s largest retailers, such as the large German food chains EDEKA and REWE. Consequently, they have escaped the limitations of local stores offering Greek products and now address a wider consumer audience, offering not only fruits / vegetables not locally produced (e.g. citruses) but also competitive with German production (e.g. asparagus).

PDO / PGI: As I already mentioned, the main advantage of Greek products in Germany is quality and our “flagship”, in this case, are PDO / PGI products, such as feta cheese and olive oil, which consumers can find in alllarge retail chains. Their sales are steadily increasing and their position is strengthening, as we will analyze below.

Organic products – Healthy eating: The consumption of organic products and, where possible, following a healthy diet is steadily gaining ground in Germany and, after a temporary decline in 2022, sales of organic products are back on an upward trajectory in 2023. Basic nutritional trends in the last 5 years are: a) limiting meat consumption, b) high consumption of fruit / vegetables, c) increased interest in vegetarian / vegan options, d) increased awareness regarding the use of fat, salt and sugar in food.

Greek companies are making significant leaps forward, recording remarkable performance in the local organic products / health food market, but compared to competing countries there is still ground to cover, while there is also great room for improvement.

What is the biggest challenge for companies or brands who want to do business in your country?

The most important challenges are, on one hand, the increased competition and on the other hand the high demands of the largest consumer market within the EU. The Greek exporter is often asked to compete with similar products from several countries, while, in particular, the large retailers have specific requirements in terms of asking quantities and delivery timing. A Greek producer with small or / and unstable production will find it difficult to build trusting relationships with a German distributor. In these cases, joining forces and cooperating with the scope to enter the German market works positively, so that these weaknesses are limited and the high standards and all kinds of demands of the German distributors / retailers are met.

In a highly competitive environment, with potential importers in Germany from all over the world, Greek export entrepreneurship has to walk the extra mile to succeed in the difficult German market, where, among other things, the element of locality has become increasingly important in recent years as a criterion for choosing food products by German consumers.

Could you talk us through some targeted actions taken to improve the position of Greek f&b products / to enhance exports to your market?

Strengthening the position of Greek food and beverages sector in the German market is a constant concern and priority of the ECA Office of the Greek Embassy in Berlin. Indicatively, some of the actions we have taken recently are mentioned right below:

– Support of ENTERPRISE GREECE and other participating organizations and businesses from Greece in the large sectoral International Fair of Fresh Fruits and Vegetables – FRUITLOGISTIKA – February 2024 (the said International sectoral Fair takes place in Berlin on an annual basis).

– Contribution and active participation in the preparation and organization of targeted actions for the promotion of Greek food products. For example: a) informational event held on the occasion of FRUITLOGISTIKA 2024 under the organizational responsibility of the Novacert company for the promotion of Greek fruit and vegetables, under the distinctive title Mediterranean Combo b) targeted informational event on the sidelines of the Berlin Greek Film Festival for the publicity and promotion of PDO Graviera Naxos, in collaboration with EAS Naxos (Union of Agricultural Cooperatives of Naxos) and DKConsultants company, that had undertaken the preparation and organization of the specific promotional event.

– Continuous and close cooperation with the Hellenic-German Chamber of Industry and Commerce, in the context of which our Office co-organized the 9th Hellenic-German Food Forum (Florina, 28-29.11.2023). I participated in person in the work of the Forum and had the opportunity to meet with the Greek and German companies that took part in the two-day event and held B2B meetings.

– Compilation of market researches for selected food sectors, such as our Office’s relatively recent market surveys for organic products and fresh fruit & vegetables in Germany.

– Last, but not least, our Office provides information and related material to every Greek exporting company that sends us a relevant request and tries to contribute in every possible way to their optimal networking and to dealing with problems and difficulties they may face.

Which are the bestselling Greek f&b products in your market?

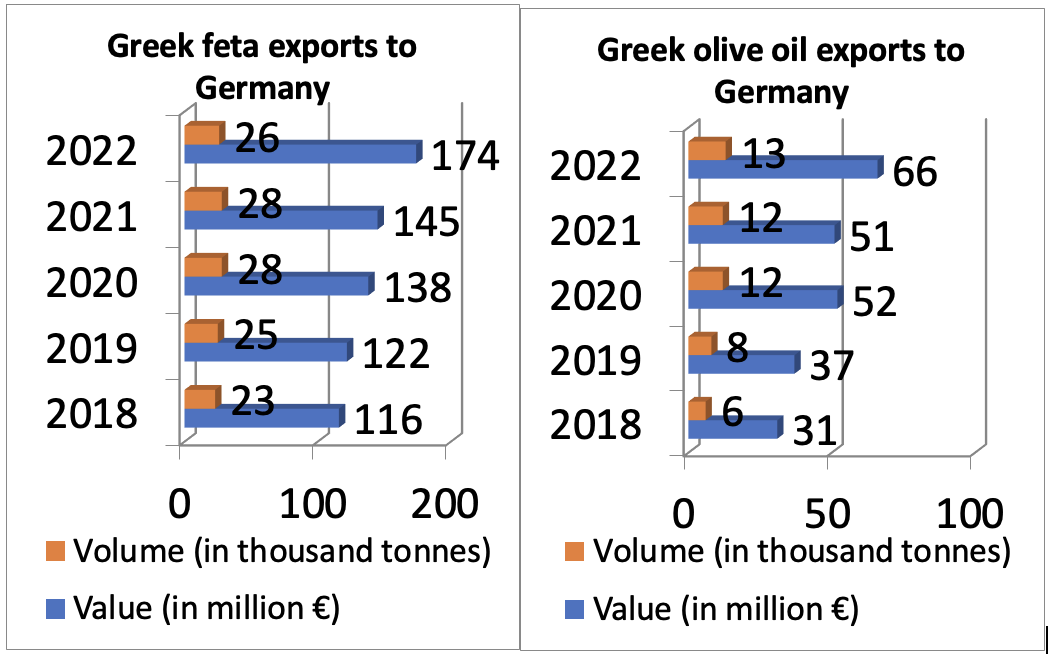

As I have already mentioned, PDO/PGI are the “flagship” of Greek f&b exports and are constantly on the rise. The following table shows the growth trends over the last 5 years in exports of feta and olive oil in Germany:

Berlin ECA Office

Address: Hiroshima Str. 11-15, 10785 Berlin

Tel: + 49 (0) 30 208 387 130-132-145

E-mail: ecocom-berlin@mfa.gr

Snapshot from Greece's participation in a Special Promotional Event for fresh fruit and vegetables, organized during this year's international exhibition of fresh fruits and vegetables (FRUITLOGISTIKA 2024), which takes place annually in Berlin and is one of the largest international and professional exhibitions of the sector. Greece participates consistently with a national pavilion under the organization and supervision of ENTERRPISE GREECE, with the involvement of the Berlin ECA Office.

Snapshot from Greece's participation in a Special Promotional Event for fresh fruit and vegetables, organized during this year's international exhibition of fresh fruits and vegetables (FRUITLOGISTIKA 2024), which takes place annually in Berlin and is one of the largest international and professional exhibitions of the sector. Greece participates consistently with a national pavilion under the organization and supervision of ENTERRPISE GREECE, with the involvement of the Berlin ECA Office. With the Head of the Region of Attica Mr. Hardalias from the recent Berlin International Tourism Fair (ITB 2024). The Berlin international tourism exhibition is the leading international tourism exhibition in which our country participates regularly. This year's Greek participation was honored with the presence of Ms. Olga Kefalogianni, Greek Minister of Tourism as well as Mr. Dimitris Fragkakis, General Secretary of the Greek Tourism Organization (EOT).

With the Head of the Region of Attica Mr. Hardalias from the recent Berlin International Tourism Fair (ITB 2024). The Berlin international tourism exhibition is the leading international tourism exhibition in which our country participates regularly. This year's Greek participation was honored with the presence of Ms. Olga Kefalogianni, Greek Minister of Tourism as well as Mr. Dimitris Fragkakis, General Secretary of the Greek Tourism Organization (EOT). Based on the data available from the German Federal Statistical Office (Destatis), in 2023 Greece exported to Germany mainly cheese products (feta is the dominant product), fresh fruit & vegetables and olive oil.

Based on the data available from the German Federal Statistical Office (Destatis), in 2023 Greece exported to Germany mainly cheese products (feta is the dominant product), fresh fruit & vegetables and olive oil.