Being one the largest fruit categories, table grapes are one of the most demanded fruit in Europe, with relatively stable. And although European table grape production is decreasing, Greece is seeing a rise in export numbers, even amid the COVID-19 pandemic.

Story: Vana Antonopoulou

According to data from the Greek Association of Export and Distribution of Fruits, Vegetables and Juices, Incofruit Hellas, the EU produces many grape varieties that are mostly intended for vinification, whereas a large part is reserved for fresh consumption and a smaller one for raisin production.

The global production of table grapes in 2019 was up by 23.4 million tons. China is the world’s largest producer and consumer of table grapes. However, its role in international trade is somewhat limited considering that both its imports and exports are relatively low. China’s production amounted to 10.8 million tons. The role of Turkey as a major powerhouse in the production and consumption of table grapes should also be mentioned. In the commercial season spanning 2019, Turkish production of table grapes was increased and amounted to 2 million tons.

The EU is the second largest producer, importer and consumer of table grapes in the world.

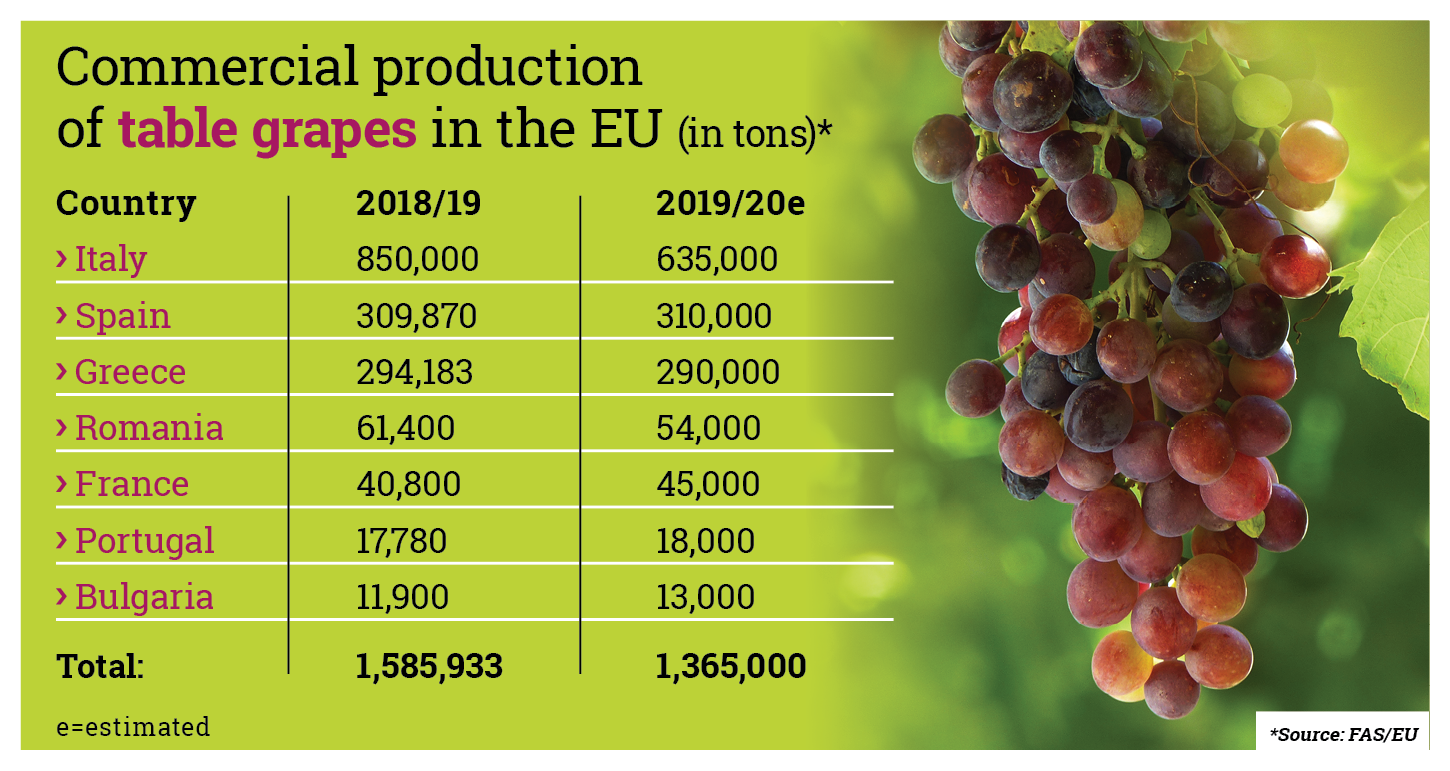

As exports continue to be low, the EU remains the main importer of table grapes in the world market. EU production amounted to 1.4 million tons in the year 2019. Within the EU, table grape production is mainly located in the Mediterranean basin. Currently, the largest producer country is Italy, which represents about 47% of total EU production. Spain is second with 23%, followed by Greece with 21%. These three countries produce more than 90% of the total EU crop.

About Greek table grapes

In Greece, table grape is centered in the regions of Macedonia, Thrace, Thessaly, Peloponnese and Crete, while the main cultivated varieties of table grapes are Flame, Superior, Victoria, Cardinal, Alphonse Lavallee, Crimson, Muscat d’Hambourg, Sultanine, Italia, and Red Globe.

Greek production for the year 2020, which is has just finished being harvested, is expected to be somewhat down compared to the previous year, at 290,000 tons, whereas its quality remains exceptional. The decline in the competitiveness of table grapes produced in Europe compared to imported ones is mainly due to small lots. In Greece, there are mostly small dual-use farms where the grapes are cultivated together with olives.

Seedless grapes lead demand

The European consumer has an increasing preference for convenience. This trend is positive for table grapes, because they are easy to consume and ideal as a fresh snack.

For the same reason, seedless varieties, such as the Thompson, Superior and Crimson which are produced in Greece, are most appealing to consumers and expected to lead the market demand further. These grapes are typically sold in clamshell packages. The convenience trend is strongest in northern Europe.

Rising exports amid pandemic

Among the top exporters globally, the fastest-growing exporters of table grapes since 2015 were: India (up 186.2%), Australia (up 116.1%), Brazil (up 32.9%) and the Netherlands (up 31%). Three countries posted declines in international sales of table grapes: Greece (down – 31.5%), Chile (down -12.9%) and the United States (down -5.9%). Even so, Greece is in number 14 at the global ranking regarding the exports of table grapes, with $97.1 million (1.2%) in value, and in number 11 in the list of the highest positive net exports for table grapes in 2019, with $94.6 million.

However, the COVID-19 pandemic has presented Greece with increased export opportunities as far as fruit and vegetables are concerned. As a result, “Table grape exports appear to be up compared to the same period from last year, with prices, however, at low levels due to the reduced consumption of the product in the domestic market,” explains Mr George Polychronakis, Special Adviser to the Greek Association of Export and Distribution of Fruits, Vegetables and Juices, Incofruit Hellas.

Regarding table grapes, the United Kingdom is the No1 export destination, in particular for the EXTRA and I categories, as well as for the larger grape sizes in the dominant seedless, white Tompson Seedlees variety.

Transparency & sustainability

Supply chains are becoming more transparent and consumers are well informed about environmental and social issues. As a result, buyers are requiring transparency and certifications from producers. They expect products to use a sustainable approach to production and processing, that include actions to strongly reduce and register the use of pesticides, ensure the safety of employees and/or even include price guarantees for producers.

A matter of taste

Because table grapes are often consumed as a snack and as a product of indulgence, one must consider consumer experience as an important success factor. Especially when dealing with experienced buyers, who appreciate premium quality and can distinguish superior taste. This means produce that are fresh, sweet and crisp, although specific preferences can differ per region and buyer.