Following the disruption created by the Covid-19 pandemic in the entire food supply chain, plant-based food, which was until then evaluated as the next best thing investment-wise, is regaining ground and is now considered the future of the food industry. And the financial part is bound to follow.

It is no breaking news: for the past twenty years, and especially the last ten, the meatless movement gains ground. Backed by the Millennials, people with various health problems that fight for their right to have quality food options, eco-activists, who keep informing about the tremendous impact increased meat consumption has on the planet, but also countries such as China, whose cuisine is essentially far more plant than meat – based, the vegan way of eating (plant-based food is its core) is no more an extreme option that makes people giggle. On the contrary: based on recent data by the leading strategic consulting and market research firm BlueWeave Consulting, the plant-based food industry is growing out of proportion. For the forecast period between 2023 and 2029, BlueWeave expects global plant-based food market size to grow at a significant CAGR of 11.82% reaching a value of USD 22.27 billion by 2029. The growing number of vegans among the earth’s population, especially in traditionally meat-consuming countries, along with the decreasing tolerance for animal protein are the two major growth drivers for the global plant-based food market.

Furthermore, the covid period and the pressure it placed on people (both patients and health workers) spotlighted the importance of excellent quality food of high nutritional value: we already knew that plant-based foods play a crucial role in the growth and repair of human cells and tissues, and after the latest research, scientists have concluded beyond doubt that plant protein is also beneficial for weight loss and building healthy muscles and tissues.

Flexitarians limit meat consumption prioritizing Plant based food and protein

Investing is on the rise

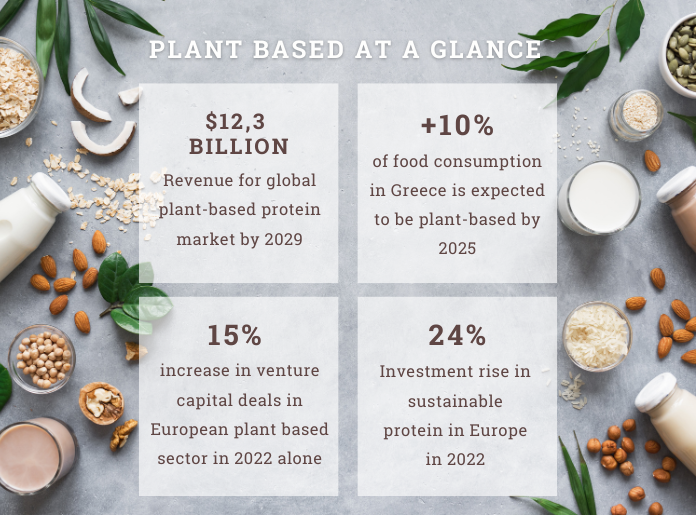

Given the huge trend and the opportunities it creates, there has been a subsequent rise in venture investments in plant-based foods production companies. Nonetheless, the cost, which remains relatively high (at least compared to animal-based products), the subsequent high prices of plant-based protein sources and the limited availability could potentially restrain -albeit temporarily- the growth of the global plant-based food market, which is anticipated to surge from USD 5.88 billion in 2022 to USD 12.30 billion by 2029 at 11.11% CAGR during the forecast period.

The Greek f&b industry, though, doesn’t seem to bat an eye, facing steady growth every year: by 2025 10% of food consumption in Greece is expected to be plant-based. This trend was enhanced by the covid crisis, leading people to increase demand in plant-based, especially plant-based meat alternatives -Greeks may not be world champions in veganism, but increasingly more people worldwide (and Greece is no exception to this rule) become flexitarians. People who deside to pick up on this particular trend follow a “flexible” diet, in other words, without eliminating it completely, they greatly limit meat consumption, prioritizing vegetables, legumes and plant-based food and protein in their diet.

This significant change has resulted in the subsequent adjustment of the industry: products such as burgers, sausages, meat balls, even greek meat “classics”, such as gyros and souvlaki, and frozen traditional Greek dishes, such as moussaka, can be found today in plant-based alternatives from a growing number of businesses operating in the meat production industry.

Another important drive is international competition, which has boosted the efforts of the Greek companies in the R&D department. Apart from the obvious challenge of texture and structure, the main emphasis is being placed on flavor: for businesses introducing plant-based meat alternatives to the market, taste is of paramount importance.

Companies know that their products have a chance to stand on the market only if they can easily pass blind taste tests, not to mention satisfy all organoleptic and quality criteria. All these parametres have been a challenge for the industry, leading to high level r&d, and top quality final products.