Very close, and yet so far: a market with complex administrative procedures, Bulgaria constitutes an interesting exporting destination for Greek brands and companies, yet demanding of a local partner who can guide them through. Nonetheless, Bulgarians hold high respect for Greek f&b. Mr. Dimitrios Michas, Head of Economic and Commercial Affairs of the Greek Embassy in Sofia, explains why the “Greek summer holiday experience” that most Bulgarians have at some point in their lives is a huge advantage in the promotion of Greek f&b products.

What would you say is the greatest asset of Greek f&b products in the Bulgarian market?

The Bulgarian food and beverage market, as a neighboring and a rapidly developing market in our region over the past decade, presents Greek exporters with considerable opportunities for absorbing the ever-increasing Greek production in this sector. Greece already exports to Bulgaria a wide range of products (about 2,500 industrial and 400 agricultural). In recent years, we have recorded a spectacular increase in f&b exports to Bulgaria in virtually all the main f&b product categories: between 2018 and 2022, the total exports of f&b products from Greece to Bulgaria recorded a marked increase by 62,8%, reaching in 2022 an approximate value of 444 million euros.

There are many factors explaining this trend, such as the geographical proximity allowing instant and cost-effective shipping of the products to Bulgaria, the strong cultural bonds established between Greeks and Bulgarians, the good name and strong reputation -synonyms of premium quality- that Greek products have acquired in the Bulgarian market over the years and, last but not least, the large number of Greek-ownership business entities active in Bulgaria in this sector.

There are also other factors to mention – not directly related to geographical or cultural reasons but to recent economic trends in Bulgaria – such as the improvement of the purchasing power of Bulgarian citizens and the significant rise in domestic private consumption over the past decade, which in turn are attributed to the consistently high growth rates of the economy, the increase in incomes and the general improvement of the standard of living of Bulgarians, especially in the large urban centers. However, in our opinion, there is a single factor which stands out as the main reason why Greek f&b products have gained such a strong reputation among Bulgarians: Inbound Tourism as an Ambassador of Greek f&b products.

In the Bulgarian mind, there is an apparent connection between popular, quality Greek f&b products and popular tourist destinations in Greece, visited by Bulgarians throughout the whole year. For example, the huge success of landmark f&b products of Greek origin in the Bulgarian market, such as ouzo, beer, olives and extra virgin olive oil, feta PDO cheese, fresh fisheries products (seabream and seabass), tomatoes and watermelons can be explained mainly by the fact that Bulgarians enjoy consuming them in large quantities during their long-duration holidays in Northern Greece mainly, either as visitors in famous Greek holiday resorts / hotels or as owners of property in popular areas in Greece such as Chalkidiki, Kavala or Thassos. Therefore, the ever-increasing popularity of Greece as a tourist destination among Bulgarians has been the main success driver behind what is considered to be the greatest asset of Greek f&b products in the Bulgarian market: their recognizability.

Which Greek products have the greatest potential and how could their dynamics improve?

The greatest potential lies in our landmark PDO-PGI products, which are widely recognized for their quality and their brand name by conscientious Bulgarian consumers but also by the catering and hospitality service providers. In our opinion, apart from well-known and widely-exported Greek PDO-PGI products like extra virgin olive oil, dairy products etc., emphasis should be placed in the future on such products as fruits and vegetables, frozen aquaculture products, wines and spirits and products of organic farming. Those products have significant potential and margin for improvement in our exports, mainly due to recent changes in consumer behavior and the dietary habits of the Bulgarian consumers.

As regards particularly the fruits and vegetables (f&v) sector, our Office has recorded a number of recent trends in Bulgaria and the bilateral exchange between Greece and Bulgaria, which open a “window of opportunity” for an even greater increase in our exports of f&v in Bulgaria:

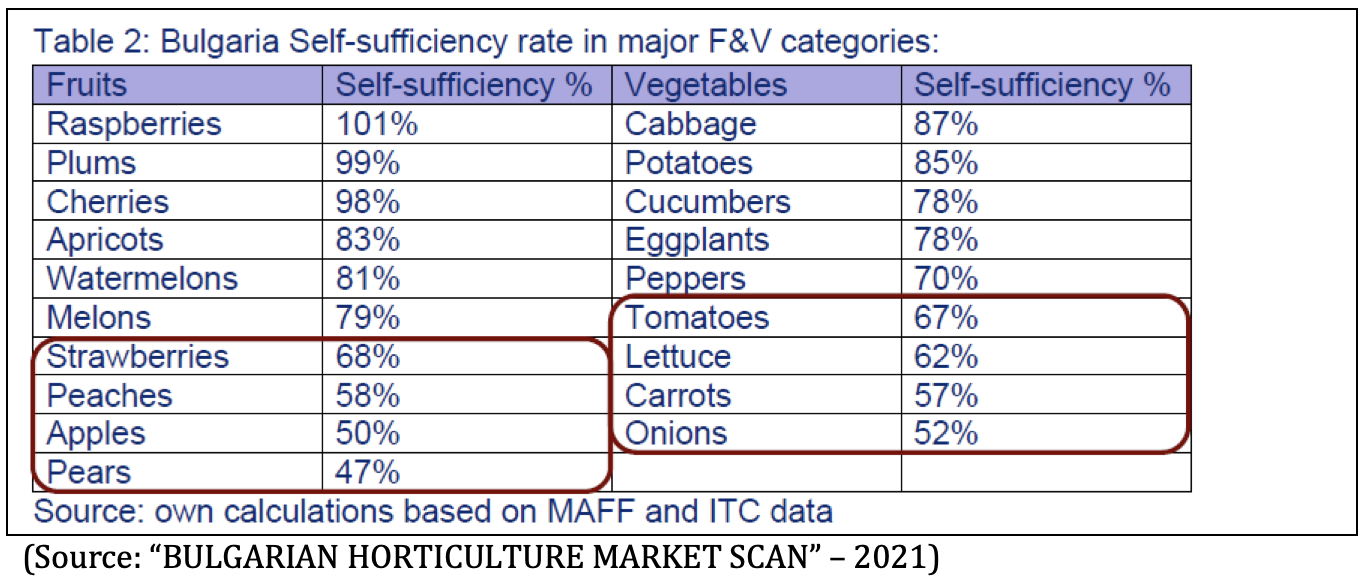

1) In recent years, Bulgaria is increasingly covering its domestic needs in f&v with imports from other countries. Domestic demand for various categories of fruits and vegetables in Bulgaria has doubled in the last ten years (2011-2019) and domestic production still cannot meet demand in 16 out of 19 seasonal products (“BULGARIAN HORTICULTURE MARKET SCAN” -2021).

The significant reduction in Bulgarian production of various f&v categories has created a shortage in the respective market in which our country enjoys a large production capacity (e.g. products such as tomatoes, strawberries, kiwis, peppers, watermelons, peaches) and, therefore, this shortage can be covered with more imports from Greece.

2) Greece’s main competitors in f&v supply to Bulgaria (Turkey, Serbia, North Macedonia, Italy, Spain) have a competitive disadvantage in relation to Greece, both at the level of product quality and at the level of “ease of access” to the Bulgarian market. In the past couple of years, access of our competitors to the Bulgarian market has become even more difficult due to disruptions and distortions in the operation of the international supply chain. What is more, f&v originating from Turkey, Serbia and North Macedonia have often been “accused” in Bulgaria of high concentrations of plant protection substances (pesticides) and are subject to regular controls (mandatory for f&v products of non-EU origin which enter EU single market territory).

3) Last but not least, an important factor that can further strengthen our export volume of f&v to Bulgaria is the proximity to Bulgaria of the various regions of Northern Greece, rich in quality f&v products. Our export dynamics in this sector is further strengthened by the operation, since 2021, of the first “Dry Port” of the “Thessaloniki Port Authority” (ThPA S.A.) in Iliyantsi area close to Sofia. It is a huge cargo-storage and handling terminal designed to receive and store large volumes of exported products which are destined for the markets of Southeast and Central Europe and represents part of ThPA’s “hinterland development” strategy. The direct railway connection of the “Dry Port” in Sofia with the Port of Thessaloniki provides with the possibility of transporting large volumes of f&v and other products from Northern Greece to Bulgaria in conditions of reduced transit time and cost. There are already regular itineraries between the Port of Thessaloniki and the Dry Port in Sofia on specific days and times and the plan of ThPA S.A. is to increase the number of routes in the coming years.

Other f&b products with favorable prospects for further export penetration in the Bulgarian market are the following:

- Wines and spirits: a steadily growing market in Bulgaria with a wide range of local and international brands and numerous Trade Fairs organized annually. Regarding wines, the market is experiencing a steady growth, with a large share covered by imports. The medium to premium quality imported wine segment, which is where Greek PDO/PGI wines can be categorized, continues to grow in a very competitive environment, creating favorable conditions to further expand our export presence in wines, especially those made from Greece’s local white grape varieties. Regarding spirits, the huge success of Greek ouzo in the Bulgarian market already speaks volumes about the popularity of Greek spirits in a market where spirits record moderate to high levels of consumption.

- Frozen aquaculture products: Bulgaria is a net importer of fish and seafood, mainly frozen fish, mollusks and crustaceans of superior quality (sardines, herring, cod, salmon, mackerel, trout, squid, surimi crab, octopus). Greece already exports significant quantities of fresh fish and seafood to Bulgaria (mainly from the Thessaloniki and Kavala fish markets). However, it does not have yet a noteworthy export presence in Frozen aquaculture products commensurate with its already large production potential in frozen packaged fish and seafood.

- Organic Food: The Bulgarian organic products / food market has been one of the fastest growing domestic economic sectors in the last decade. In the year 2022, it continued to grow at an annual rate of 3.2% compared to 2021, while its value is estimated at approximately €37.5 million. The main driver behind this growth is the strong focus of the Bulgarian consumers on a healthier lifestyle and the perception that organic products are healthier and of higher quality compared to conventional products. An important role in the development of the domestic organic food market has been played by the recent rapid development of e-commerce in Bulgaria, which began during the peak of the pandemic period and continues uninterrupted. Imported packaged organic foods dominate the domestic market. Large retail chains are the main “channel” for access of such products to the domestic market and represent approximately 68% (2021) of packaged organic food sales compared to 32% (2021) of traditional retailers (Source: https://apps.fas.usda.gov).

Dynamics of our exports in f&b products are already very favorable, yet they can further improve through concerted and targeted actions for promoting popular Greek brands in the Bulgarian market as well as through the adoption of alternative product diversification strategies by exporting Greek firms in the sector, in order to better suit the growing needs of the Bulgarian market for premium quality products in more competitive prices.

What is the biggest challenge for companies or brands who want to do business in your country?

Between 2020 and 2022 the f&b industry sector in Bulgaria faced a series of challenges, such as the consequences of the COVID-19 pandemic in the structure and functioning of the market, the ensuing supply chain disturbances, post-COVID recovery measures, the war in Ukraine, high energy prices and growing inflation. All these resulted in significant cost of living increases, most substantial in grocery products[1], and further diminished consumers’ purchasing power. This required the grocery retail, food service, and food processing industries to adapt quickly to the new environment, which they successfully did despite facing hurdles. At the same time, this winter the caretaker government of Bulgaria introduced a mechanism to monitor and control food prices across the entire supply chain, aiming at spotting unfair commercial practices and “curbing” food prices. This serious challenge still exists, yet it is a seasonal challenge powered by extraordinary geopolitical events and factors exogenous to Bulgaria.

However, there are also more stable challenges, endemic to Bulgaria, which present foreign companies and brands with various obstacles in their endeavor to enter the market and do business with Bulgarian partners. Such challenges are:

1) Regulatory and legislative unpredictability (e.g. frequent changes in national laws and regulations regarding the food processing industry).

2) Inefficient bureaucracy and a slow-moving Court system.

3) Long and arduous processes of acquiring various permits (e.g. construction permits).

4) Aging population with low purchasing power.

Generally speaking and judging from our own experience at the Commercial Affairs of the Embassy, in Bulgaria entrepreneurs encounter very often incidences of fraud or long bureaucratic and licensing procedures, which make their effort in entering the market particularly difficult. For these reasons, before entering the Bulgarian market, companies who wish to do business in Bulgaria should make a thorough business plan and an assessment of their given capabilities and the level of acceptability and recognizability that their promoted brand (product or service) enjoys in Bulgaria. This is of course a difficult exercise for a company which doesn’t have previous experience in a foreign market with the characteristics of Bulgaria. Yet, this is the main reason why we strongly suggest to interested parties from Greece (with serious intentions to do business in Bulgaria) to establish cooperation with a local partner who can guide them through complex procedures with the Bulgarian administration and effectively manage the development of relationships with potential partners (at least in the early stages of implementing the business development plan).

From the outbreak of the war in Ukraine (24 February 2022) until the beginning of 2023, basic food prices had skyrocketed in Bulgaria by over 50%, even though some foods, like butter, oil, cheese, milk and eggs, had been already more expensive in Bulgaria than in other wealthier countries in Europe.

Are there any targeted actions that can improve the position of Greek f&b products and potentially enhance exports to the Bulgarian market?

As part of its annual tasks, the Office for Economic and Commercial Affairs of the Embassy of Greece in Sofia proposes and implements a number of targeted actions and promotional activities for Greek products and services in the local market. Among them, a substantial number deals with the promotion of exports of f&b products, which is a top priority in Bulgaria of both our economic diplomacy services and our export-oriented business community.

Our Office has established communication and collaboration with big wholesalers-distributors and big retail chains of f&b and FMCG products in Bulgaria and regularly takes initiatives to “connect” them with Greek companies interested in exporting to Bulgaria. In addition, we regularly organize and coordinate numerous business missions of Bulgarian companies who visit big Food and Beverage Trade Fairs in Greece (e.g. Food Expo in Athens and FRESKON in Thessaloniki) and participate as “Hosted Buyers”. Also, we support the participation of Greek f&b companies in Trade Fairs in Bulgaria, such as the annual “InterFood & Drink Expo” in Sofia and the “FoodTech & Vinaria” in Plovdiv. Apart from Fairs, we support participations of Greek wineries and the distributors of their products in the annual “Balkans International Wine Competition and Festival” which takes place in Sofia, Bulgaria [https://balkanswine.eu/program/].

In parallel, we maintain an open channel of communication with trade bodies, companies and media from Greece in order to provide them with direct and accurate information about the main trends in the Bulgarian f&b sector as well as about the opportunities and threats identified in the local market.

Quite recently, we have started an initiative, together with local distributors, Greek restaurants and Delicatessen stores of quality PDO-PGI products of Greek origin in Sofia, in order to jointly participate with “Greek stands” in international events and festivals taking place in Sofia and, thus, further promote Greek products and the Greek culinary tradition in Bulgaria. Those events and festivals, such as the recent “International Spring Festival of Sofia” (4-7 May, 2023), traditionally attract huge numbers of visitors, locals or members of the expatriate community residing in Sofia. They provide us with a good opportunity to promote Greek f&b products and recipes in an effective and less costly manner compared to other promotional activities.

Furthermore, we have already proposed to organize, with the support of such organizations as the “ENTERPRISE GREECE INVEST & TRADE” Agency, a culinary event exclusively focused on Greek gastronomy and the benefits of a healthy Mediterranean diet in a selected place in Sofia. Last but not least, our Office regularly reports to both Greek and Bulgarian competent authorities incidences and cases of illegal marketing and distribution of registered Greek PDO-PGI products in the market of Bulgaria, which constitute violations of the European Community legislation concerning PGIs and PDOs products[1].

What are the best-selling Greek f&b products in your market

According to the preliminary 2022 Hellenic Statistical Authority’s (ELSTAT) data, the main products of the f&b sector which our country exported to Bulgaria are:

- Beer. Beer has been the best-selling Greek f&b product in Bulgaria for two consecutive years (2021 and 2022). This can be attributed to two facts: a) Bulgaria has one of the highest annual beer consumption per capita in Europe (77 liters in 2021), b) Greek beer brands are popular among Bulgarians, from their summer holidays spent in Greece every year, c) Despite the difficulties associated with the pandemic, breweries are among the best and most stable employers in Bulgaria.

- Vegetable Oils. This category mainly includes extra virgin olive oil, our landmark PDO-PGI export product, but also other cooking oils, such as sunflower oil (palm oil is excluded from this category) exported from our country.

- Fresh Bananas. Companies storing and moving bananas from Greece have established a successful “banana business hub” for the whole Balkan region and have increased exports of Fresh Bananas to Bulgaria and other Balkan countries over the years. The main brands represented in the Bulgarian market are “CHIQUITA” and “DOLE”.

- Table olives. In recent years, they have recorded a remarkable increase, both in value and quantity. In 2020, the first and most severe in its economic and trade consequences pandemic year, olives were the best-selling Greek f&b product in Bulgaria (export value: €15.88 mm), a fact which reflects its huge success and recognizability in the Bulgarian market. However, we must point out that significant volumes are exported to Bulgaria in bulk, thus becoming the object of PDO-PGI misuses and misleading labeling in Bulgaria.

- Fresh tomatoes. Bulgaria is by far the top destination of Greek origin “Tomatoes, fresh or chilled” over the years. In 2021, Bulgaria received a 52% (!) share of total Greek Fresh tomatoes’ exports globally, a figure indicative of the importance that the Bulgarian market has for our exports in this commodity group (0702). Despite those impressive figures, there are even greater margins and prospects for improvement of our export performance in tomatoes, as there are only two main tomato suppliers to Bulgaria (Greece and Turkey) and the country’s production capacity in tomatoes has stagnated over the past few years.

- Ouzo. Greek ouzo’s success in the Bulgarian market is unparalleled, when compared with any other neighboring country and is a result of two main factors: a) the popularity of spirits’ consumption among Bulgarians, as part of their drinking tradition and habits, and b) the “connection” – in the Bulgarian mind – of ouzo with their overall “Greek summer holiday experience”, which entails a combination of good quality Greek seafood and Greek entertainment (music, dance) by the beach.

- Fresh Fish – sea bream and sea bass. The momentum of Greek exports in these categories remains upward in the past few years. Although Bulgaria is mainly a meat-eating country, lately the trends regarding the consumption of fish are changing and fish products are gaining popularity and an increasing share in the local food market. Greek origin fresh fish is the most popular and abundant of this kind in the Bulgarian market (retail chains and fish markets) and its success is once again associated with the “Greek summer holiday experience” of most Bulgarians who visit Greece and consume fresh fish in its resorts every summer.

[1] REGULATION (EU) No 1151/2012 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL of 21 November 2012 on quality schemes for agricultural products and foodstuffs.

Office E.C.A. Sofia

Evlogi Georgiev 103, Sofia 1504

BULGARIA

Telephone:(003592) 9447959 9447790

ecocom-sofia@mfa.gr

“BULGARIAN HORTICULTURE MARKET SCAN” – 2021

“BULGARIAN HORTICULTURE MARKET SCAN” – 2021