One of the greatest transit hubs in the world, the Netherlands is a market where all sorts of products are in aflod, food being no exception. Also, the demand for constant product flow and availability, regardless of weather, financial or other impediments, makes it two times more difficult for Greek products to stand out, let alone create a stable market connection. Nonetheless, there are ways to penetrate the demanding Dutch market. Mr. Evangelos Dairetzis, Head of the Economic and Commercial Affairs (ECA) Office in Hague of the Greek Embassy in the Netherlands explains to Ambrosia Magazine the whereabouts of a market where abundance is reality.

Interview: Charitomeni Vonta

What would you say is the greatest asset of Greek f&b products in the Dutch market?

The Dutch market, which is Europe’s largest transit hub and given its highly competitive character, understandably has an abundance of food products flooding the market. The excellent quality of the Greek products that make up the popular and growing Mediterranean diet in Western societies is the most important guarantee for entering the demanding Dutch market. In addition, the Greek diet, one of the healthiest and tastiest in the world, surpasses the traditional diets and cuisines of the rest of the Mediterranean countries due to its special characteristics and huge variety. The high quality combined with the affordable price certainly add a comparative advantage to Greek products compared to similar ones from other Mediterranean countries. The fact that they still do not hold the position they deserve is due to factors such as insufficient production quantity, export management and lack of a strong Greek brand name.

What are the Greek products with the greatest potential, and how could their dynamics improve?

There is this opinion, that Greek products are a complementary option for the Dutch given the disproportion between the “small” Greek production and the huge range of markets that serve the Netherlands. I believe that at least some of them can become a main and not a supplementary option for the Dutch, given our export success in other markets without a significant Greek presence in the past. Fresh products have great potential, but the main requirement of the market, in addition to the competitive price, is a long shelf life, which, among other things, limits operating costs. At this point, it is worth mentioning Spain’s export success with an 11% share of total Dutch fruit and vegetable imports and “dominance” among the Mediterranean/similar to Greek products. As far as fruit and vegetables are concerned, we mention Greek products with significant potential in the Dutch market such as peppers, fresh grapes, kiwis, strawberries, peaches, cherries, apricots, citrus fruits, watermelons and melons.

Secret of success: large quantities and stable deliveries throughout the year, even with a financial loss at certain times/years of production, to achieve a stable and not occasional / opportunistic market presence.

The prospects for olive oil in large chains but also in the niche market are important, table olives which cover 40% of imports without the recognition of other countries, hard cheeses, yogurt (although a large part of the rising demand is about “greek style”), honey and wine that has been gaining ground in recent years. Vegan innovative products that meet the ever-increasing needs of the young, mainly vegan consumers also have remarkable potential.

What is the biggest challenge for companies or brands who want to do business in your country?

Given that the Netherlands is one of the largest transit centers, quality and low-cost products from all over the world are traded here, increasing the competition. In food, Greek products, in markets where they are sold, are “lost” in the multitude of corresponding varieties, while in fruit and vegetables the concept of seasonality doesn’t exist (eg watermelon in February).

A basic requirement of the food market in fresh produce is long shelf life, which limits operating costs. This is usually achieved with new, “developed” varieties (fruits, vegetables, nuts), noting that the majority of Greek fruits and vegetables come from “traditional” (non-modern) varieties.

Given the particularly large size of food businesses and the strong competition, the main requirement is the constant delivery of large quantities of specific (stable) quality. Also, the market is constantly looking for new products (mixing foods, new varieties, practical and “convenient” solutions/ready-to-eat foods, different packaging etc) to differentiate from the competition. Most Greek exporting companies are small and medium-size enterprises with production and export capacity, which, while it may be sufficient for the Greek market, is considered, in most cases, small for the Dutch market.

Targeted actions taken to improve the position of Greek f&b products / to enhance exports to your market.

To what we have already said, we should add a parameter that the local food importers emphasize: the Dutch market lacks the Greek “brand name” in the sense of a recognizable quality Greek product. It is therefore necessary to develop a more comprehensive brand name (not only in the field of agricultural products), which will present Greece as a developed country, covering the entire range of production activities, whose products have special quality characteristics making them superior to their peers from other countries.

Actions for the promotion of Greek food and drinks are no different from actions in the developed markets of Western Europe such as store promotion, advertising campaigns in media and social media, tastings (wine, olive oil, table olives etc), food festivals, invitations of buyers to exhibitions in Greece, publications in professional magazines, hosting influential journalists, influencers, etc. Several of these actions have been implemented in the Dutch market with positive results. The familiarization of the ever-increasing number of Dutch tourists in our country with Greek cuisine and Greek flavors is another positive aspect.

Finally, with the exception of a limited number of Greek export companies that – due to their size – can meet the market requirements as mentioned above, small and medium-sized companies are encouraged to approach the Dutch market as a side project, in the context of a more general export policy focused on other neighboring European markets (e.g. German, French), as the entry cost is particularly high in relation to any expected benefit. At this point it is worth noting that the PLMA private label exhibition that takes place annually in Amsterdam is the largest of its kind worldwide and is a relatively “easy” and less expensive way to enter the market, with the disadvantage of course of not promoting the export company’s brand name.

What are the best selling Greek f&b products in your market?

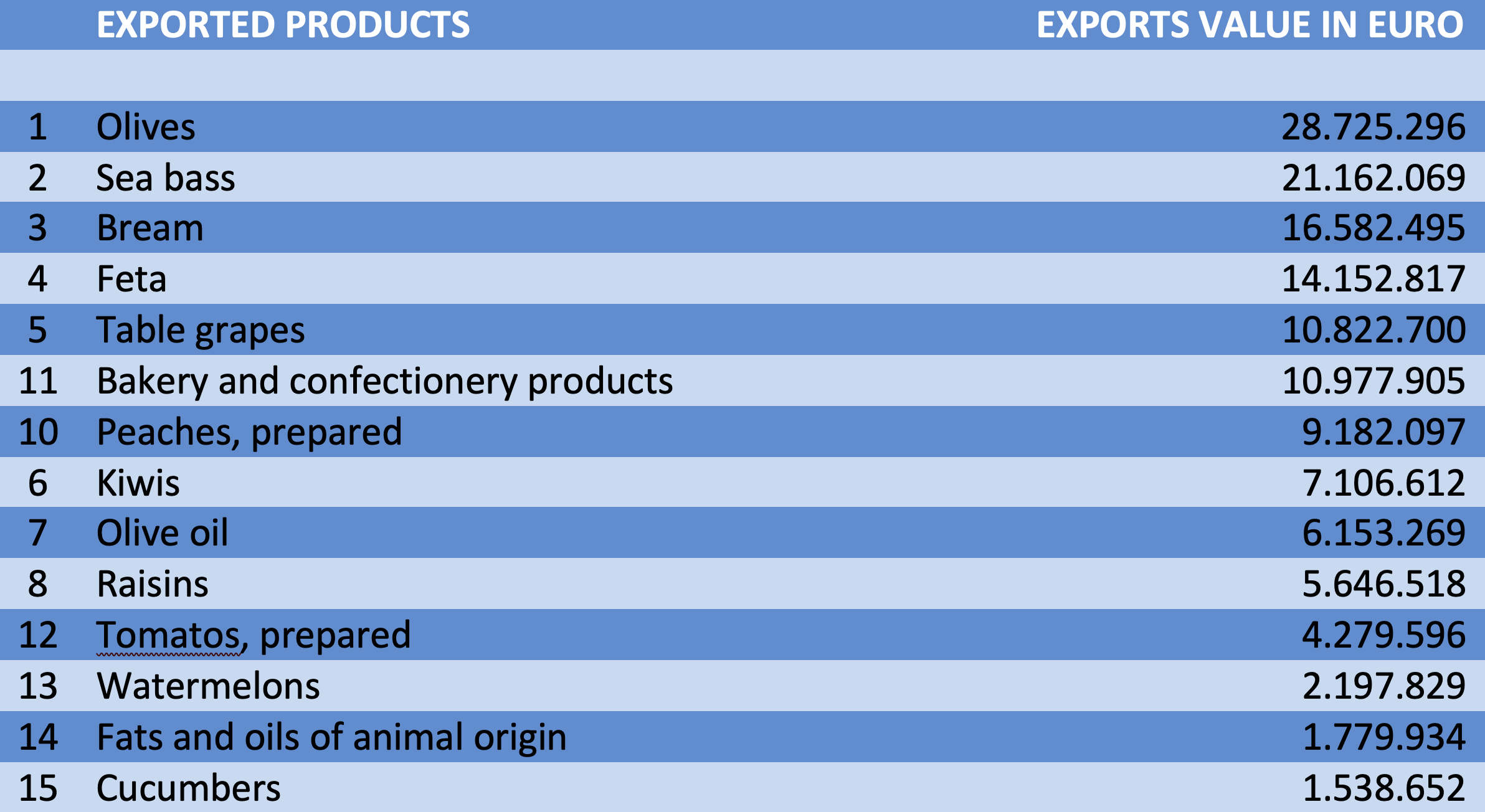

The “flagships” of the Greek food sector such as feta cheese, olive oil, table olives, fish farming products, grapes have had good export performance in recent years, with an upward trend.

Let us take a look at some examples: 3.8 M euros worth of olive oil exports in the Netherlands in 2018, increased to 6.15 M euros in 2022, i.e. an increase of 62%. In 2022, approximately 40% of the total table olives imports are of Greek origin compared to 27% in 2018. During the same period, fish exports recorded a 73% increase. Cheese exports from 8.9 M euros in 2018 increased to 15.5 M in 2022, i.e. a 72% increase.

Mr. Evangelos Dairetzis, Head of the Economic and Commercial Affairs (ECA) Office in Hague of the Greek Embassy in the Netherlands.

Mr. Evangelos Dairetzis, Head of the Economic and Commercial Affairs (ECA) Office in Hague of the Greek Embassy in the Netherlands.