The British market is one of the largest, most cosmopolitan, greatly competitive markets in the world. Being placed in this kind of environment is an accomplishment of its own, let alone standing out. This is exactly what the Greek f&b companies have done during the last twenty years, through excellent packaging, and fresh, original marketing, but also aided by the covid momentum, which helped the world renew their interest in the Mediterranean diet, valuing its undeniable benefits. Ms Vivian Kabouroglou, Head of the Economic & Commercial Section of the Embassy of Greece in London gives Ambrosia Magazine the insights on this highly demanding commercial environment, especially after a record year (2022) for Greek exports to the UK in all categories.

What would you say is the greatest asset of Greek F&B products in your market?

Greece’s agri-food industry has a significant history which has become a force of strength for Greek f&b exports worldwide. The past decade has demonstrated the vitality of the sector, with multiple companies bringing history and modernity into harmony, by promoting the timeless qualities of traditional Greek raw materials and produce through fresh and original marketing. Building on quality and tradition, Greek F&B companies are constantly innovating and are now manufacturing products that are increasingly adapted to consumer demand in large, foreign export markets, like the one of the UK.

The UK is one of the major markets for imported food & drinks worldwide, importing close to half of the food it consumes, as a result of consumer demand for products that cannot be grown or manufactured within the country. It is also a wealthy and diverse market, providing opportunities for a wide range of premium ingredients and products grown in Greece, such as truffles and saffron. Most importantly, the UK is at the forefront of emerging global market trends that shape the future of the industry, with rising demand for alternative products such as “free from”, organic and plant-based, in which Greek food manufacturers are more and more present and successful.

While already well established in the UK, Greek food products can, therefore, keep tapping into new opportunities the British market has to offer. A distinctive variety of recognizable PDO/PGI, high-quality products, differentiating themselves from global food manufacturers, are gaining market shares in higher added value segments of the British market. Driven by the wider recognition of key standards of health and physical fitness after the COVID-19 pandemic, a renewed interest in the Mediterranean Diet, as one of the healthiest dietary patterns, reputed for its demonstrated preventive effect of cardiovascular and other diseases, is an excellent ambassador for Greek F&B products in the UK and worldwide.

The best-selling Greek F&B products in your market

F&B products make up almost 30% of total yearly exports from Greece to the UK. The main food export categories and products are dairy products, natural honey, as well as preparations of vegetables, fruit, and nuts. According to British statistical data, these categories combined produced an annual export value of more than 230 million pounds in 2022.

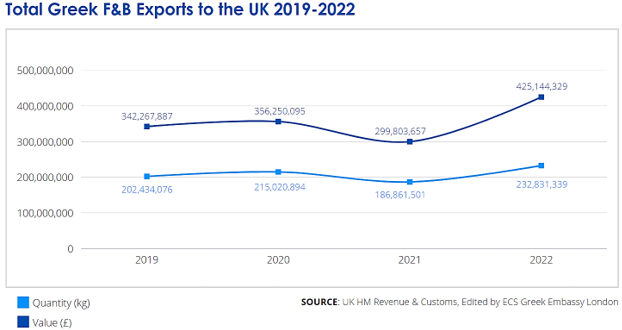

The year 2022 was excellent for Greek F&B exports to the UK, as they reached their highest point in the last five years, both in value and in volume. Total export value amounted to 425 m pounds, increased by more than 40% compared to 2021, while exports also rose by 25% in volume over the same year. Products such as Feta cheese, olives, yogurt and food preparations are amongst the best-selling products in our bilateral trade, representing together close to 15% of total Greek exports to the UK.

It is also worth noting that 2022 was a record year for Greek exports to the UK in all categories, with total export value rising by 72% compared to 2021 (65% according to Greek statistical data). Although part of the rise in value terms can be attributed to inflation, Greek exports to the UK also rose by more than 35% in volume, showing a renewed dynamism after the pandemic.

Which Greek products have the greatest potential, and how could their dynamics improve?

The past year brought with it multiple game-changers in Greek F&B exports, with a number of new entries taking the lead alongside more established products. More specifically, meat and preparations of meat or fish exports increased more than two-fold in 2022, while their export value keeps rising in the first months of 2023. Another fast rising export category includes the products of the milling industry, (flour, starches etc) which marked an increase in value by 400% between 2021 and 2022 and maintained a two-fold value increase in the first three months of 2023. A more traditional but very dynamic export category remains that of edible vegetables, as it has seen an increase in export value by 250% in just the first three months of 2023. Lastly, among the most steadily increasing products in the F&B category are products involving preparations of cereals, as well as dairy and pastry products. These products noted an increase in export value of 65% in 2022 and were still thriving during the first four months of 2023.

A special mention must be made to Greek wine, which has maintained a steady increase over the last five years, despite the COVID-19 pandemic, culminating in an annual increase in value of 50% between 2021 and 2022. UK wine consumers have shown a renewed interest in indigenous Greek grape varieties, such as Assyrtiko and Xinomavro, placing them among the fastest growing in popularity in 2023.

What is the biggest challenge for companies or brands who want to do business in your country?

During the last few years, Brexit, coupled with the outbreak of COVID-19 and the global geopolitical and macroeconomic challenges of the war in Ukraine, have considerably impacted the UK economy, resulting in significant supply chain problems and increased costs.

After Brexit, new administrative barriers have arisen and businesses have had to adapt to the new trading relationship with the EU with the UK as a third country. However, as a phased approach to implementing border controls on EU imports was adopted by the British government, the UK rules for importing agri-food products from the EU are currently less restrictive than the ones for exporting from the UK to the EU; thus, according to most trade data sources, exports from the EU to the UK have grown in most categories between 2019-2022. Nonetheless, Brexit has led to good deal of uncertainty for companies wishing to place their products on the UK market, with a number of deadlines having been repeatedly postponed by the British Government, as well as regulatory changes concerning specific products introduced or underway (i.e. wine reform).. Finally, in April , the British government published its draft Border Target Operating Model (TOM), which proposes a new approach to security as well as sanitary and phytosanitary regulations, aiming for controls to be simplified, digitised and, over time, delivered through the UK’s new Single Trade Window, which will render UK external trade more efficient. A government consultation on the TOM is still underway with results and decisions due to be published in the near future.

While arguably more straightforward compared to those of other third countries, the new trade relation with the UK is nonetheless a barrier for smaller companies which have previously only operated in the EU market and hence have no experience of export to third countries. Moreover, Brexit has enabled the UK to enhance trade relations with third countries through bilateral (Australia, New Zealand) or regional Free Trade Agreements (CPTTP), which may, in the future, reduce EU’s share in UK external trade.

Last but not least, the current combination of high inflation, the cost of living crisis and anaemic growth (“slowcession”), has made UK consumers decrease the quantities of food and drink they buy, without, however, sacrificing quality – an additional challenge, but also an opportunity for Greek quality products.

Are there any targeted actions taken to improve the position of Greek F&B products and enhance exports to your market?

After the pandemic, there has been a concentrated effort to enhance the visibility of Greek F&B products in the UK market. In 2022-2023, Greece has been present and active in all major F&B international exhibitions in the UK, namely, the Speciality & Fine Food Fair, the International Food & Drink Event (IFE), the Natural and Organic Products Europe, as well as the Food and Drink Expo in Birmingham. These exhibitions witnessed the cooperation of multiple stakeholders, such as local Chambers and Regions, with around 80 companies and cooperatives showcasing their products to a total audience of 65.000 attendees.

Greece was also, undeniably, one of the protagonists of the 2023 London Wine Fair, with a collective pavilion hosting a total of over 40 wineries-the third largest pavilion of the Fair- while eminent Masters of Wine presented Greek PGI and PDO grape varieties in a number of masterclasses. To uphold the renewed interest in Greek wine, masterclasses and wine-tasting sessions continued to take place after the London Wine Fair, financially supported by Enterprise Greece, the official Agency for export promotion and investments, immersing international wine traders, business owners and sommeliers in the world of Greek wine, in London and in other important cities. A large number of targeted promotional events, for wine were also organized under the auspices of the Hellenic Ministry of Agriculture and co-funded by the EU, through the special support programmes for the Promotion of European products to third countries.

Finally, the Economic and Commercial Section of the Greek Embassy, as part of its day to day mission, has provided information and support to companies wishing to export their products to the UK market and is planning a number of targeted actions and events aiming to uphold and increase the current dynamism of Greek F&B products in British market.

Embassy of Greece in London, Economic & Commercial Section

1A Holland Park, W11 3TP London

Τ.+44(0)207 727 8860

E-mail: ecocom.london@mfa.gr

London Wine Fair 2023 (May 15-17, London). Ms Kabouroglou with the Embassador in London, mr Giannis Tsaousis (first from the left) and Greek exhibitors.

London Wine Fair 2023 (May 15-17, London). Ms Kabouroglou with the Embassador in London, mr Giannis Tsaousis (first from the left) and Greek exhibitors. London Wine Fair 2023 (May 15-17).

London Wine Fair 2023 (May 15-17).